If you’ve been keeping an eye on the Ottawa housing market, you probably noticed things felt a little quieter toward the end of the year. That’s exactly what the latest market data shows — a typical December slowdown, softer sales activity, and steady prices wrapping up a year defined by balance and stability.

But don’t mistake “quiet” for “weak.” In fact, Ottawa’s real estate market ended 2025 in a stronger position than many might expect.

Let’s break down what happened, what it means for buyers and sellers, and where the opportunities are heading into 2026.

A Year That Defied the Usual Real Estate Rhythm

Unlike a typical year, 2025 didn’t follow Ottawa’s usual real estate pattern.

Spring arrived later than normal in terms of market activity. Instead of a big early-season rush, the market eased into motion. Summer stayed surprisingly steady, avoiding the usual mid-year slowdown. Then, as fall and early winter arrived, activity cooled again — giving the year an unconventional but consistent rhythm.

Despite the quieter November and December finish, total home sales in Ottawa ended 2025 up 1.3% compared to 2024, and total dollar volume increased 4.1% year-over-year. That points to a market driven by real demand — not urgency or speculation.

In other words, Ottawa’s market stayed grounded in fundamentals.

Ottawa Continues to Show Price Stability

While some larger Canadian cities experienced sharper price corrections, home prices in Ottawa remained broadly stable throughout the year. December data shows inventory levels dipping slightly, but still offering buyers more choice than in recent years.

With roughly 4.3 months of inventory, Ottawa sits in what’s considered a balanced market — not heavily favoring buyers or sellers.

This stability is one reason Ottawa continues to stand out as a resilient real estate market in Canada.

Detached Homes Lead the Way

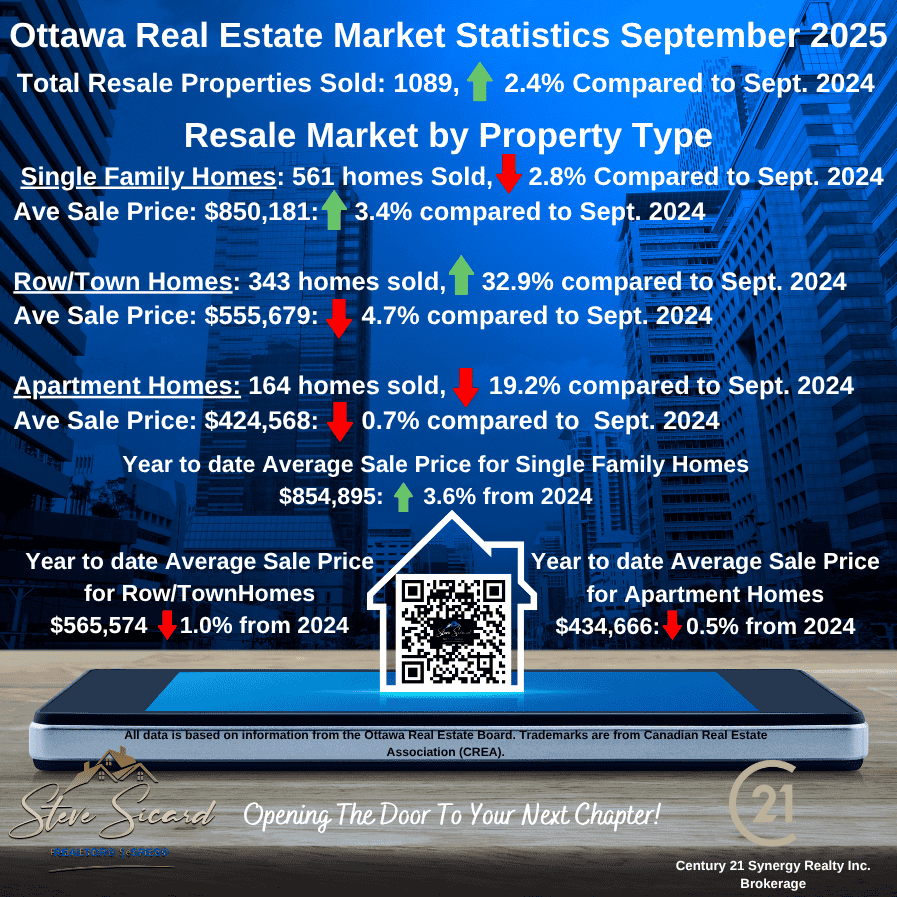

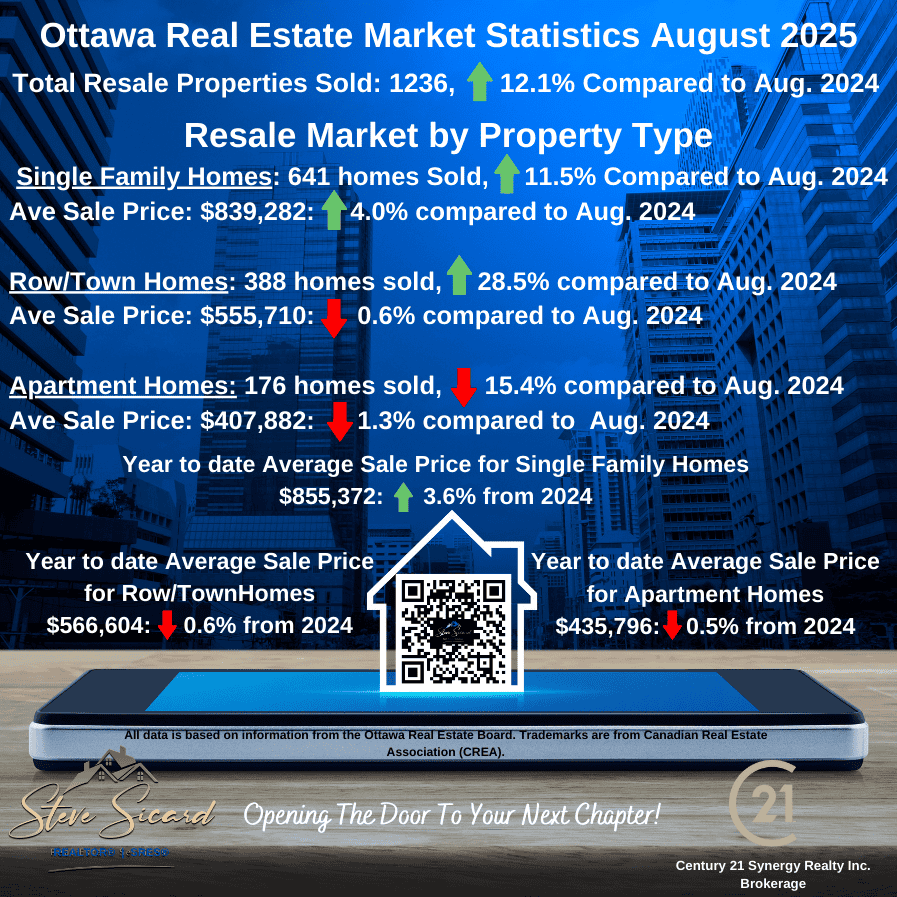

Not all property types performed the same.

Detached homes remained the strongest segment in Ottawa. Sales were steadier, prices held firm, and buyer demand remained consistent.

Townhomes saw slightly higher inventory levels, meaning buyers have more options and sellers need to price strategically. While sales activity stayed reasonably resilient, mild pricing pressure is starting to appear.

The Condo Market: Softer, But Worth Watching

The Ottawa condo market remains the softest segment right now.

Apartment-style homes saw lower sales activity and higher months of inventory — nearing eight months, which is above balanced market conditions. As supply grows faster than demand, average condo sale prices declined year-over-year.

Ottawa hasn’t experienced the extreme condo oversupply seen in larger urban markets, but this segment is definitely one to watch closely in 2026.

For buyers, this could mean opportunity.

For sellers, preparation and pricing strategy matter more than ever.

What This Means for Buyers and Sellers in 2026

For buyers, the current Ottawa market offers more choice, steadier pricing, and less pressure than in recent years. That means more time to make thoughtful decisions — especially in the condo and townhome segments.

For sellers, Ottawa’s stability is good news — but strategy matters. Detached homes remain in demand, while condos and townhomes require sharper pricing and strong presentation to stand out.

The Bottom Line

Even with a quieter end to the year, Ottawa’s real estate market in 2025 proved stable, balanced, and resilient. Sales and total dollar volume both outperformed 2024, showing steady underlying demand rather than market stress.

As Ottawa heads into 2026, buyers can expect more options, sellers can count on stable pricing (with the right strategy), and everyone benefits from a market that’s driven by real fundamentals — not panic or pressure.