On September 17, the Bank of Canada made a move that’s got buyers and sellers paying attention — they cut their key policy interest rate by 0.25%, bringing it down to 2.5%.

The reason? Slowing global growth and easing inflation pressures. In plain English, the Bank wants to help keep the economy steady — and that small rate cut could open new doors for homebuyers who’ve been sitting on the sidelines waiting for a break.

So what does this mean for Ottawa’s real estate market? Let’s take a closer look.

🏡 Ottawa’s Market: Staying Strong Through the Fall Slowdown

September usually brings a bit of a seasonal slowdown — kids are back in school, families are busy, and the market takes a breather. But Ottawa showed its usual resilience this fall.

Here’s what’s standing out:

Sales are still above 2024 levels, even though activity eased slightly.

Prices remain stable despite more homes coming on the market.

The rate cut could boost confidence for first-time buyers and bring a little extra energy to the market in the months ahead.

Paul Czan, President of the Ottawa Real Estate Board (OREB), summed it up perfectly:

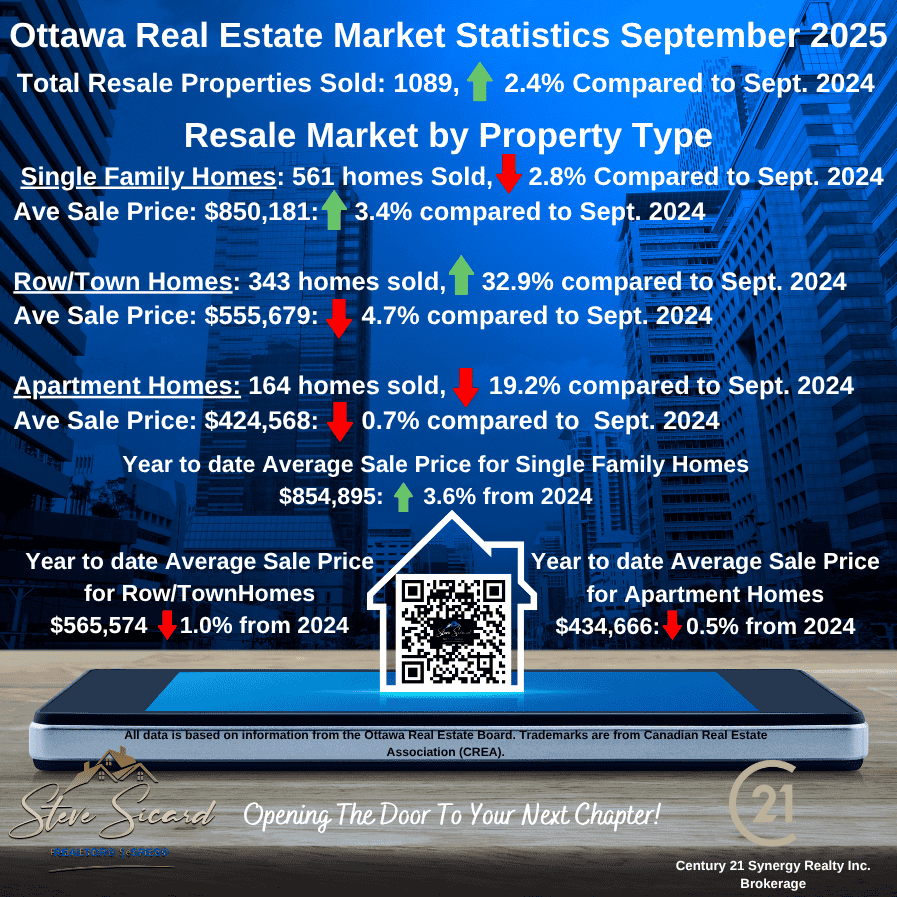

“September reinforced Ottawa’s resilience. Sales were nearly 2.4% higher than last year, and prices are holding steady despite more listings coming to market.”

He also noted that while single-family home sales are slowing a bit, townhomes are keeping things balanced. And although Ottawa’s housing mix continues to grow, there’s still a shortage of “missing middle” homes — like townhouses and smaller family-friendly options — that bridge the gap between condos and detached houses.

📊 Ottawa Market Snapshot (September 2025)

Total sales so far this year: 11,025 — up 3.9% from this time in 2024

Average sale price (September): $690,397 — up 0.3% year-over-year

Year-to-date average price: $699,910 — up 2.7% from the first nine months of 2024

Overall, Ottawa’s market remains balanced — steady prices, steady demand, and cautious optimism as rate cuts begin to ripple through the economy.

💬 Want Market Info That’s Specific to Your Neighbourhood?

Curious about how your local market is doing — whether prices are rising, holding steady, or starting to shift?

You can get custom market updates based on your neighbourhood and how often you’d like to receive them:

✅ Monthly

✅ Quarterly

✅ Semi-annually

✅ Annually

Just click the button below to submit your request — and I’ll make sure you get clear, easy-to-understand updates that matter to you and your home.

Comments:

Post Your Comment: